The Big Idea

Most people think paying down the home loan is the end of the story. You shovel money in, and eventually, the debt disappears. Great. But the wealth stops there.

Debt recycling flips the script. It’s a way to pay off your non-deductible home loan (your Principal Place of Residence, or PPOR) faster while building an investment portfolio at the same time. Done right, it’s one of the most powerful wealth accelerators available to everyday Australians.

And here’s the kicker: it’s 100% legal and supported by the ATO—as long as you follow some simple rules.

How It Works

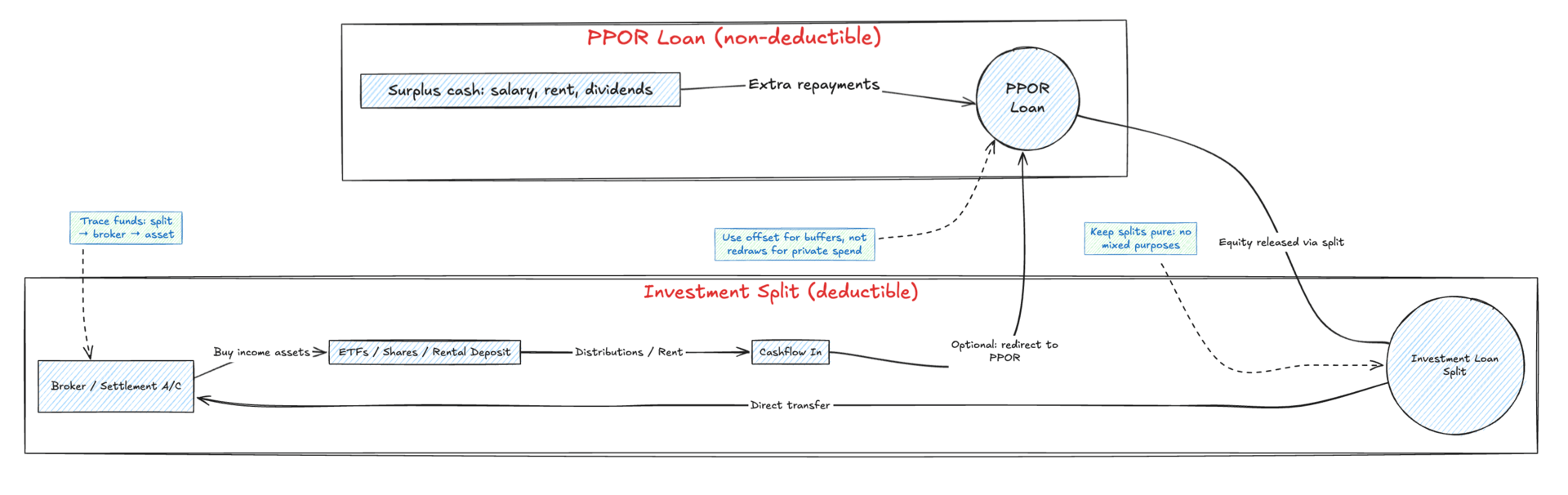

Think of your home loan as having two buckets:

Bucket 1: Your non-deductible loan (your PPOR mortgage)

Bucket 2: Your investment split (borrowings used only for investments)

The goal is to shrink Bucket 1 as fast as possible, while reborrowing into Bucket 2 to invest. The interest on Bucket 1 isn’t deductible, but the interest on Bucket 2 is—because those funds are used to generate income.

Here’s the loop:

You put all surplus cash (salary, dividends, rent) into Bucket 1 to reduce it.

Each time the balance drops, you reborrow the same amount into Bucket 2.

You invest that borrowed money into income-producing assets (shares, ETFs, property).

Over time, Bucket 1 disappears, Bucket 2 grows, and your net worth climbs faster.

The Golden Rules

The ATO doesn’t mind debt recycling, but they do mind if you play silly games. Here are the rules to keep it clean:

1. Purpose test. Interest is only deductible if the borrowed funds are used for investments that earn assessable income. Buy ETFs, dividend shares, or a rental property deposit? Fine. Buy a new car? Forget it.

2. No mixing purposes. Never combine private spending and investments in the same loan split. Keep them quarantined.

3. Evidence matters. You must be able to show a clean paper trail: loan split → brokerage account → investment purchase. No detours through your everyday account.

4. Avoid ‘schemes’. Don’t try to capitalise private interest or run fancy split-loan strategies that artificially shift repayments. That’s where people get into trouble (think FCT v Hart).

5. Offsets vs redraws. Use offsets for flexibility, redraws for precision. Never redraw for private use out of your investment split—it contaminates deductibility.

A Simple Example

Sarah has an $800k mortgage on her home (her PPOR). She creates a $200k split dedicated to investing.

She borrows $200k from the investment split and buys a portfolio of ETFs yielding 4%. That’s $8,000 income p.a.

Interest cost at 6.5% is $13,000. That interest is deductible because the purpose of the loan was investment.

Sarah uses the $8,000 distribution plus $20,000 of her salary to hammer down her PPOR loan faster.

Next year, she repeats the process, drawing another $20k from the split to invest.

Over 10 years, her home loan shrinks, her investment portfolio compounds, and she’s built a second engine of wealth without waiting until the mortgage is gone.

Three Ways to Recycle

1. Shares & ETFs

The simplest option. Regularly drip-feed borrowed funds into broad-market ETFs or dividend-paying stocks. Liquid, diversified, easy to administer.

2. Property deposits

Use the split for the deposit and costs on a rental property. The rental income plus capital growth accelerates your wealth. Make sure every expense comes from the investment split.

3. Value-add projects

Borrow to fund a renovation on an investment property, or improvements that increase rent. So long as the purpose is income-producing, the interest is deductible.

Where It Fits in the 4 Stages of a Property Portfolio

Debt recycling is mainly a Stage 2 Growth strategy (check out the stages defined here). It’s all about compounding faster while you’re still building.

Stage 1 Acquisition: Usually premature, unless you have strong cashflow discipline and surplus funds.

Stage 2 Growth: Prime time. Accelerates equity creation while shrinking bad debt.

Stage 3 Consolidation: Can continue in a smaller, conservative way, but focus shifts to derisking.

Stage 4 Harvest: By now the PPOR debt should be gone, and the recycling engine has done its work. The focus turns to stability and income.

In other words, debt recycling is a tool for the middle game. It helps you bridge the gap between simply holding properties and having a fully de-risked, income-producing portfolio.

What Not To Do

Mix investment and personal spending in the same split. You’ll lose deductibility and create accounting nightmares.

Assume security = deductibility. It doesn’t matter what property secures the loan; what matters is what you use the money for.

Forget about buffers. Rate rises and market dips happen. Always hold cash in an offset as a safety net.

Advanced Tips

Loan splitting: Set up multiple small investment splits rather than one giant one. Easier to track and match each drawdown to specific investments.

Regular reviews: Do a quarterly reconciliation. Make sure every borrowed dollar is traceable.

Stress test: Model what happens if rates rise 2–3%. If the numbers still hold, you’re in safe territory.

Structure smarts: Borrow personally to subscribe for units in a unit trust. The trust then invests. That way, you retain individual serviceability while holding assets collectively.

Why It Works

Debt recycling works because it does two things at once:

Kills bad debt (your PPOR loan).

Builds good debt (deductible, income-producing investments).

Instead of waiting 25 years to pay off the mortgage before you start investing, you’re building wealth from day one.

Reflection

This isn’t a magic trick. It’s a disciplined system. The investors who win with debt recycling are the ones who keep their splits clean, their records tight, and their buffers healthy.

Done right, it’s one of the most effective ways to accelerate wealth in Australia without taking silly risks.

See you next week!

Alex Zarate

Disclaimer

This article is for educational purposes only. It does not constitute financial, tax, or legal advice. Everyone’s circumstances are different. Please seek professional advice before acting on any of the strategies outlined above.