Ask someone how their property’s performing and you’ll usually get one of two answers:

“It’s gone up 10% this year.”

“It’s yielding 6%.”

Both are fine, but both are incomplete. It’s like judging a restaurant by whether the chips were hot — sure, it matters, but what about the steak, the service, and the wine list?

Property returns are never just one thing. They’re the combination of three levers you can pull at different stages of your investing journey:

Capital Growth – the market + time + location fundamentals

Cashflow – rent, debt, tax, expenses

Manufactured Equity – renovations, developments, value-adds

Get your head around these three, and suddenly property investing stops feeling like guesswork and starts feeling like engineering.

Lever 1: Capital Growth (the compounding machine)

This is the lever we all love to brag about. Growth is the silent compounding engine that takes an $800k house and turns it into a $2m house while you’re busy living your life.

How it works:

Macro drivers: population growth, infrastructure, employment hubs, supply constraints

Micro drivers: school catchments, walkability, street appeal, zoning

How to tilt the odds:

Buy in proven locations with demand and limited future supply

Prioritise lifestyle factors (parks, transport, schools)

Hold long enough to let compounding do its magic

Trap: If you rely on growth alone, you’ll go broke before you get rich. You need cashflow to keep you in the game.

Lever 2: Cashflow (the oxygen tank)

Cashflow is not sexy. No one brags at barbecues about their $8,000 surplus. But without it, you suffocate. Cashflow is what keeps you solvent while growth does its slow burn.

What affects it:

Rent: market demand, upgrades, tenant quality

Debt: interest rates, LVR, IO vs P&I

Expenses: insurance, rates, maintenance, land tax

Tax: depreciation, negative/positive gearing, ownership structure

How to tilt the odds:

Improve rent with upgrades, re-leasing, or furniture

Reprice debt and don’t be lazy with your bank

Systematise maintenance and shop around for insurance

Trap: chasing high yield in terrible locations. A 10% yield is useless if the value halves and no one wants to live there.

Lever 3: Manufactured Equity (the accelerator pedal)

This is the active lever — where you create value instead of waiting for the market to gift it to you.

Ways to play:

Cosmetic reno (kitchen, paint, flooring)

Layout tweaks (add bedroom, granny flat)

Small development (duplex, subdivision, DA uplift)

Commercial value-add (re-lease, refit, increase NOI)

How to tilt the odds:

Buy below replacement cost

Be conservative with costs, blowouts happen

Have multiple exit strategies

Trap: overcapitalising or forgetting about time delays. It’s not a win if your “$70k reno” costs $120k and takes 2 years.

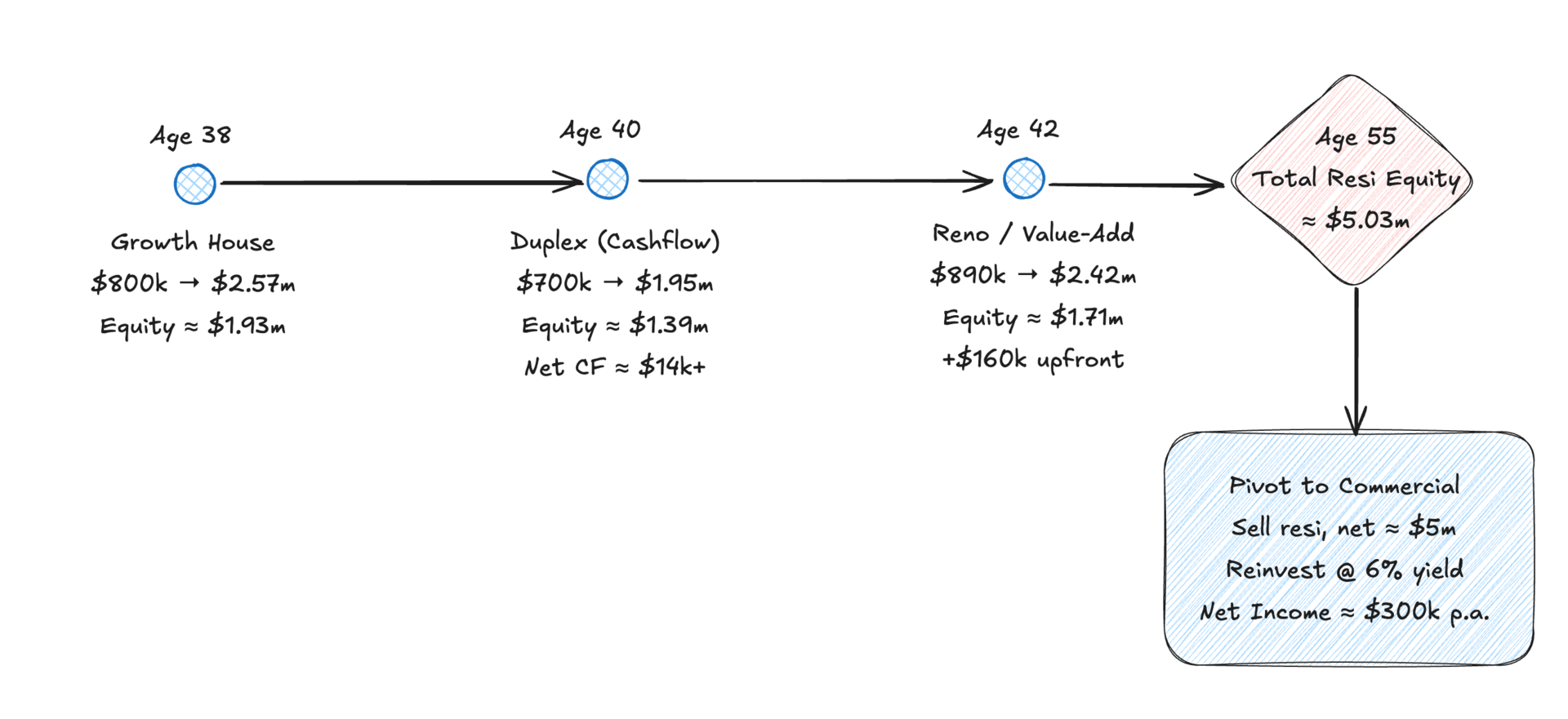

Case Study: Sam’s $120k Freedom Plan

Meet Sam. He’s 38, with 17 years until his target “freedom age” of 55. He wants $120k of stable, passive income so he can choose whether to keep working or not.

Here’s how he uses the three levers with a sensible 2-year gap between each purchase so that he can accumulate enough deposits and buffers. Read on and see why he will be pleasantly surprised at the end.

Year 0 (Age 38) – Growth House

Buy: $800k

Debt: $640k (80% LVR)

Held for 17 years at 7% growth → Value ≈ $2.57m

Debt still ≈ $640k (assuming IO until pivot)

Equity ≈ $1.93m

Year 2 (Age 40) – Regional Duplex (Cashflow Play)

Buy: $700k

Debt: $560k

Held for 15 years at 7% growth → Value ≈ $1.95m

Equity ≈ $1.39m

Plus net cashflow of ≈ $14k/year, growing over time

Year 4 (Age 42) – Reno / Manufactured Equity

Buy: $750k + $100k reno + $40k costs = $890k all-in

Debt: $712k

Reval after reno: $1.05m → $160k equity created instantly

Held for 13 years at 7% growth → Value ≈ $2.42m

Equity ≈ $1.71m

Portfolio Snapshot at 55

Growth house equity: $1.93m

Duplex equity: $1.39m

Reno equity: $1.71m

Total equity ≈ $5.03m

Sam’s sitting on a serious equity base. But his rental net income is only around $60k p.a. Nice, but not the $120k he’s after.

The Pivot to Commercial

At this point, Sam does what many seasoned investors do: he harvests his resi gains and pivots into commercial.

Sells all three resi assets

Nets roughly $5m after costs

Reinvests into commercial property at 6% net yield

$5m × 6% = $300,000 net income p.a.

That’s well above Sam’s $120k freedom number. Even with buffers for vacancies and costs, he’s set.

Why This Pivot Makes Sense

Residential is the growth engine. It compounds wealth and builds scale.

Commercial is the income engine. Higher net yields (5–7%), longer leases, more predictable tenants.

The trade-off is simple: less capital growth upside, but much more stability. For someone who’s built their nest egg and now values certainty over speculation, it’s a smart move.

The Equation in Action

What Sam did wasn’t complicated:

Total Return = Growth + Cashflow + Manufactured Equity

Growth gave him the compounding power

Cashflow kept him in the game

Manufactured equity sped up his equity creation

And the pivot turned all of that into stable income

Practical Tips

Run a lever audit: For each property, ask yourself: Is this giving me growth? Cashflow? Equity potential? If it’s not doing at least one well, why do you own it?

Stage-match your strategy:

Early = growth focus

Middle = blend in manufactured equity

Mature = pivot to cashflow stability

Keep buffers: Always have 6–12 months of holding costs in offset. Equity is useless if you can’t pay the bills.

Plan your pivot: Don’t wait until you’re 55 to think about it. Have a clear strategy for when and how you’ll shift from resi to commercial.

Common Mistakes

Obsessing over growth but bleeding cashflow

Buying for yield alone in dud markets

Overcapitalising on renos

Thinking resi will give you retirement income without a pivot plan

Reflection

When you see property as three levers instead of one number, the whole game changes.

You stop waiting for the market to rescue you. You start designing your returns - you just need to invest some elbow grease if you need to move things along quicker.

Like Sam, you can build wealth in stages, then flip the switch when you’re ready to turn wealth into lifestyle.

Anyways… thanks again for reading this week’s editio and being part of the journey.

See you all next week.

—Alex

Disclaimer

This article is for educational purposes only. It does not constitute financial, legal, or tax advice. Everyone’s circumstances are different. Please seek professional advice before acting.